Why Police Officers Need Life Insurance Cover

Police officers have one of the most dangerous jobs in the world, and the risks they face on a daily basis are countless. From violent encounters with criminals to accidents while on duty, police officers put their lives on the line each day to protect their communities. As such, having life insurance cover is critical for police officers to ensure their dependents are financially protected in the event of their untimely death. In this article, we’ll explore the importance of police officer life insurance cover, different types of policies available, and the best insurance companies that offer coverage for police officers.

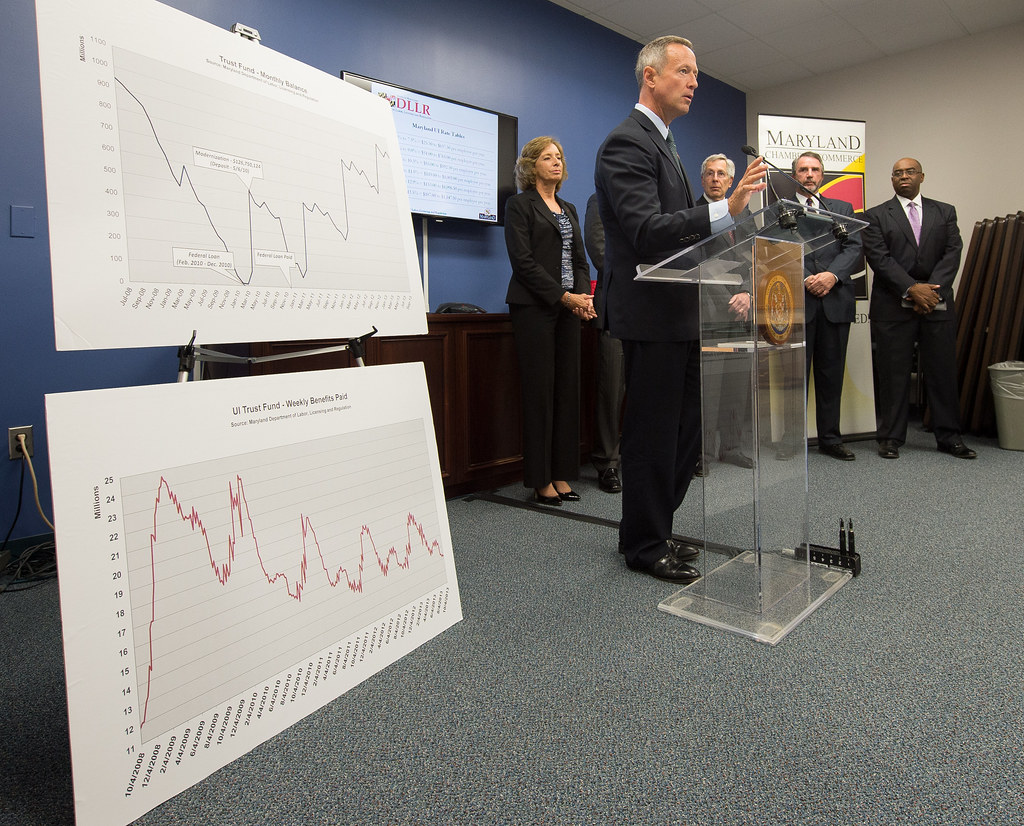

Statistics on Risks Faced by Police Officers

- According to the National Law Enforcement Officers Memorial Fund, 264 police officers were killed in the line of duty in 2020 in the US alone.

- The same report shows that 48 officers died due to firearms-related incidents, 44 died due to traffic-related incidents, and 145 died due to other causes.

- It’s estimated that nearly 60,000 law enforcement officers are assaulted each year in the US, according to the Bureau of Justice Statistics.

Financial Protection for Family and Dependents

Police officers have families and dependents like everyone else, and their financial obligations and responsibilities are no different. In the event of their death, their loved ones may face financial difficulties in paying for expenses like mortgage payments, medical bills, and other debts. Life insurance cover ensures that their dependents are financially protected and can maintain their standard of living even after they’re gone.

Importance of Adequate Coverage

Employer-sponsored life insurance policies may not be enough to cover the financial needs of police officers and their dependents. It’s important to consider factors like family expenses, debt, and retirement needs when determining the amount of coverage needed. Underinsuring can be a costly mistake, as it may leave dependents with inadequate financial resources in the long run.

Types of Life Insurance for Police Officers

There are different types of life insurance policies available for police officers, and each has its own features and benefits. According to HelpAdvisor, term life insurance is a popular option for police officers, as it provides coverage for a specific period of time, usually between 10 and 30 years. This type of policy is often the most affordable option, as the premiums are generally lower than other types of policies. Term life insurance is ideal for police officers who need coverage for a specific period of time, such as until their mortgage is paid off or their children are grown up.

On the other hand, whole life insurance is a type of permanent life insurance that provides coverage for the entire life of the policyholder. This type of policy has a fixed premium, and a portion of the premium is invested by the insurance company to build cash value over time. Whole life insurance is more expensive than term life insurance, but it provides lifelong coverage and can be used as an investment vehicle.

Another type of permanent life insurance is universal life insurance. According to Consumer Coverage, this type of policy provides flexibility in terms of premiums and death benefits. Universal life insurance allows the policyholder to adjust the premiums and the death benefit amount as their financial needs change over time. Universal life insurance is more complex than term life insurance, but it offers more flexibility and can be customized to meet the specific needs of the policyholder.

It’s important to compare the features and benefits of different policies before making a decision. Police officers can consult with an insurance agent or use online comparison tools to find the best policy that suits their needs.

Factors to Consider When Choosing Life Insurance Cover

Choosing the right life insurance policy can be a daunting task, especially for police officers who face unique risks and financial obligations. Here are some factors that police officers should consider when choosing life insurance cover:

Financial Obligations and Responsibilities

The first factor to consider is the policyholder’s financial obligations and responsibilities. According to Policygenius, police officers should consider their income, debt, mortgage payments, and other expenses when determining the amount of coverage needed. The policy should be enough to cover these expenses and ensure that their dependents are financially protected in the event of their death.

Employer-Sponsored Coverage

Many police departments offer employer-sponsored life insurance policies, but these policies may not be enough to cover the financial needs of police officers and their dependents. According to LifeInsure, police officers should review their employer-sponsored policies and consider purchasing additional coverage to meet their financial needs.

Debt and Mortgage Payments

Police officers may have significant debt and mortgage payments that need to be considered when choosing life insurance cover. According to SelectQuote, life insurance payout can be used to pay off debts, including mortgage payments, credit card debts, and other loans.

Retirement Planning

Police officers should also consider their retirement needs when choosing life insurance cover. According to HelpAdvisor, term life insurance can be a good option for police officers who need coverage until their retirement savings are sufficient.

Family and Dependents’ Needs

Finally, police officers should consider their family and dependents’ needs when choosing life insurance cover. According to Consumer Coverage, life insurance policies can provide financial protection for dependents, including paying for education and other expenses.

Overall, police officers should carefully consider their financial needs and obligations when choosing life insurance cover. It’s important to work with an insurance agent or use online comparison tools to find the best policy that meets their specific needs.

Top Life Insurance Companies for Police Officers

There are many life insurance companies that offer coverage for police officers, and it can be difficult to determine which ones are right for you. Here are some of the top life insurance companies that provide coverage for police officers:

Protective

Protective is a top-rated life insurance company that offers coverage specifically for police officers and first responders. According to HelpAdvisor, Protective offers competitive rates and flexible coverage options to meet the unique needs of police officers.

Banner Life

Banner Life is another highly-rated life insurance company that provides coverage for police officers. According to HelpAdvisor, Banner Life offers affordable rates and flexible coverage options, making it a popular choice among police officers.

Lincoln Financial Group

Lincoln Financial Group is a well-known life insurance company that provides coverage for police officers. According to HelpAdvisor, Lincoln Financial Group offers a range of policies to meet the unique needs of police officers, including term life insurance, universal life insurance, and whole life insurance.

Prudential

Prudential is a well-established life insurance company that provides coverage for police officers. According to Consumer Coverage, Prudential offers competitive rates and specialized policies for high-risk professionals, including police officers and first responders.

MetLife

MetLife is another top-rated life insurance company that provides coverage for police officers. According to Policygenius, MetLife offers affordable rates and customizable policies to meet the unique needs of police officers.

Comparison of Different Life Insurance Companies

When choosing a life insurance company, police officers should compare the features and benefits of different policies. According to LifeInsure, some of the factors to consider when choosing a life insurance company include financial stability, customer service, and policy options. It’s important to work with a reputable insurance agent or use online comparison tools to find the best policy and company that suits your needs.

Overall, there are many reputable life insurance companies that provide coverage for police officers. By comparing the features and benefits of different policies, police officers can find the right coverage to meet their unique needs and financial situation.

Tips for Buying Life Insurance Cover as a Police Officer

Buying life insurance cover as a police officer can be overwhelming, but the following tips can help make the process easier:

Assess Your Needs

Before purchasing life insurance cover, assess your needs and financial obligations. According to Policygenius, police officers should consider their income, debt, mortgage payments, and other expenses when determining the amount of coverage needed. The policy should be enough to cover these expenses and ensure that their dependents are financially protected in the event of their death.

Compare Policies

It’s important to compare policies and rates from different insurance companies. According to HelpAdvisor, police officers should compare policies from at least three different companies to find the best coverage at the best price. Working with an insurance agent or using online comparison tools can help make the process easier.

Consider Additional Riders

Additional riders can be added to a life insurance policy to provide additional coverage and benefits. According to SelectQuote, police officers should consider adding riders such as accidental death and dismemberment coverage and long-term care coverage to their policy.

Be Honest When Applying

When applying for life insurance cover, be honest about your job duties and the risks associated with your job. According to Consumer Coverage, life insurance companies will ask additional questions when applying for coverage, including job duties, whether you are armed, and your level of specialized training. It’s important to answer these questions truthfully to ensure that you receive the appropriate coverage.

Work with a Reputable Insurance Agent

Working with a reputable insurance agent can help ensure that you find the best life insurance policy for your needs. According to LifeInsure, an insurance agent can help you navigate the complex insurance industry and find policies that meet your specific needs.

By following these tips, police officers can find the right life insurance coverage to meet their needs and protect their loved ones in the event of their death.

Common Questions About Life Insurance Cover for Police Officers

Here are some common questions that police officers may have about life insurance cover:

Does Being a Police Officer Disqualify Me from Life Insurance?

No, being a police officer does not disqualify you from getting life insurance. According to HelpAdvisor, many insurance companies offer coverage specifically for police officers and first responders.

Is Employer-Sponsored Life Insurance Enough for Police Officers?

Employer-sponsored life insurance policies may not be enough to cover the financial needs of police officers and their dependents. According to LifeInsure, police officers should review their employer-sponsored policies and consider purchasing additional coverage to meet their financial needs.

Will I Pay More for Life Insurance Because I am a Police Officer?

Police officers may pay more for life insurance coverage because of the risks associated with their job. According to SelectQuote, insurance companies will take into account the risks associated with a police officer’s job when determining rates.

What Type of Life Insurance is Best for Police Officers?

The best type of life insurance for police officers depends on their specific needs and financial situation. According to LifeInsure, term life insurance is often the most affordable option for police officers.

Can I Get Life Insurance if I Have a Pre-Existing Medical Condition?

It may be more difficult to get life insurance if you have a pre-existing medical condition, but it is still possible. According to Policygenius, some insurance companies offer policies specifically for people with pre-existing medical conditions.

How Much Life Insurance Cover Do I Need as a Police Officer?

The amount of life insurance cover you need as a police officer depends on your financial obligations and responsibilities. According to Policygenius, police officers should consider their income, debt, mortgage payments, and other expenses when determining the amount of coverage needed.

By understanding these common questions about life insurance cover for police officers, you can make informed decisions about your coverage and find the right policy to meet your needs.

Protect Your Family’s Future with Life Insurance Cover for Police Officers

As a police officer, your job is to protect and serve your community. But have you taken steps to protect your family’s future? Life insurance cover is an essential tool for police officers to ensure that their loved ones are financially protected in the event of their death. By following the tips and advice outlined in this article, you can find the right life insurance coverage to meet your needs and protect your family’s future.

Remember to assess your needs, compare policies, and work with a reputable insurance agent to find the best coverage at the best price. By being honest when applying for coverage and considering additional riders, you can ensure that you receive the appropriate coverage for your unique needs.

Don’t wait until it’s too late to protect your family’s future. Get started today by exploring the life insurance options available to police officers. Check out our website for more great content on insurance and financial planning.

Frequently Asked Questions

Who qualifies for Police Officer Life Insurance Cover?

Being a police officer does not disqualify anyone from coverage.

What type of life insurance is best for police officers?

The best type of life insurance for police officers depends on their specific needs.

How much life insurance cover does a police officer need?

The amount of life insurance cover needed depends on financial obligations.

Who offers life insurance policies for police officers?

Companies like Protective, Banner Life and Lincoln Financial Group offer policies.

What if I have a pre-existing medical condition?

Some insurance companies offer policies specifically for people with pre-existing medical conditions.

Will I pay more for life insurance because I am a police officer?

Police officers may pay more due to the risks associated with their job.