As a new accounts clerk in banking, you’re often tasked with managing sensitive financial information, making it essential to have comprehensive life insurance coverage. But with so many options available, choosing the right coverage can be overwhelming. That’s why we’ve put together this step-by-step guide to help you navigate the world of life insurance and make an informed decision that best suits your needs. Read on to discover everything you need to know about mastering life insurance options for new accounts clerks in banking.

Understanding the Basics of Life Insurance for New Accounts Clerks in Banking

As a new accounts clerk in banking, it’s important to understand the basics of life insurance cover. Life insurance is a contract between you and an insurance company, where you pay a premium in exchange for a lump sum payment to your beneficiaries upon your death. There are two main types of life insurance: term life and permanent life. Term life provides coverage for a specific period of time, while permanent life provides coverage for your entire life. As a new accounts clerk, you may want to consider term life insurance as it is more affordable and can provide coverage during the years when you have the most financial responsibilities. It’s important to also consider factors such as your age, health, and financial obligations when choosing the right coverage for your needs.

Types of Life Insurance Coverage Available for New Accounts Clerks in Banking

Types of Life Insurance Coverage Available for New Accounts Clerks in Banking

When it comes to life insurance coverage, there are two main types that new accounts clerks in banking should consider: term life insurance and permanent life insurance.

Term life insurance provides coverage for a specified period, typically 10 to 30 years. This type of policy is generally more affordable and can be a good option if you only need coverage for a specific period or have limited funds.

On the other hand, permanent life insurance provides lifetime protection and accumulates cash value over time. It also offers more flexibility with options such as whole life, universal life, and variable universal life policies.

It’s important to note that both types of policies have their own benefits and drawbacks depending on your individual circumstances. Consider factors such as your age, health condition, financial situation, and long-term goals when choosing the right type of coverage for you as a new accounts clerk in banking.

Factors to Consider When Choosing Life Insurance Coverage as a New Accounts Clerk in Banking

When choosing a life insurance coverage as a new accounts clerk in banking, there are several factors to consider. Firstly, you need to determine your financial obligations and how much coverage you need to meet those obligations. This includes any outstanding debts, mortgage payments, and future expenses such as your children’s education. Secondly, you need to consider your age and health status. If you are young and healthy, term life insurance may be a more affordable option. However, if you have pre-existing medical conditions or are older, permanent life insurance may be a better choice. Lastly, consider the reputation and financial stability of the insurance company before making a decision. Look for companies with high ratings from independent rating agencies such as A.M. Best or Standard & Poor’s. By taking these factors into consideration, you can make an informed decision on the best life insurance coverage for your needs as a new accounts clerk in banking.

How to Determine the Right Amount of Life Insurance Coverage for Your Needs

When determining the right amount of life insurance coverage for your needs as a new accounts clerk in banking, it’s important to consider several factors. One key factor is your current financial obligations, such as any outstanding debts or mortgages. You’ll want to ensure that your life insurance policy provides enough coverage to pay off these debts in the event of your unexpected passing.

Another important factor is your future financial needs, such as your children’s education or retirement savings for your spouse. You’ll want to consider how much money would be needed to cover these expenses and ensure that your life insurance policy provides enough coverage for them.

It’s also important to regularly review and adjust your life insurance coverage as your financial situation changes over time. By taking the time to carefully consider these factors, you can determine the right amount of life insurance coverage for your needs as a new accounts clerk in banking.

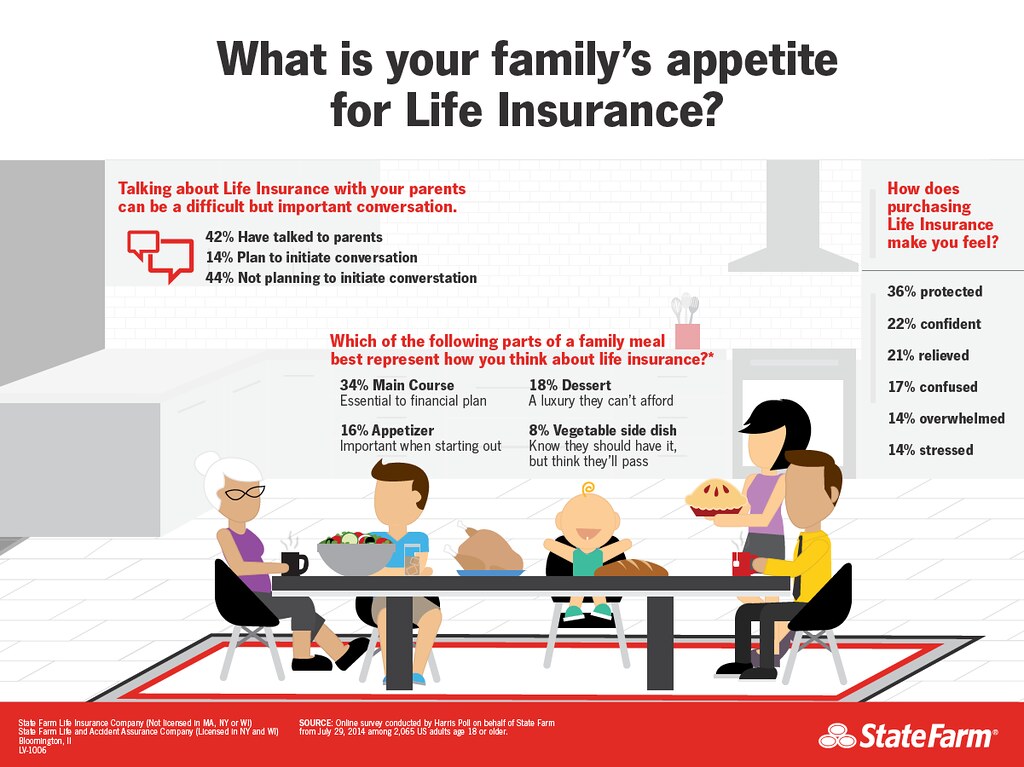

Comparing Life Insurance Quotes and Rates for New Accounts Clerks in Banking

Comparing life insurance quotes and rates is an essential step in choosing the right coverage for new accounts clerks in banking. It’s important to obtain quotes from multiple insurance providers to ensure you’re getting the best deal. When comparing quotes, pay attention to the coverage amounts, deductibles, and any additional benefits or riders offered. Don’t forget to consider the financial stability and reputation of the insurance company as well. While it may be tempting to choose the cheapest option, make sure you’re not sacrificing necessary coverage for a lower premium. Additionally, consider the convenience of payment options and customer service when making your decision. Taking the time to compare quotes and rates can save you money in the long run while providing peace of mind for you and your loved ones.

Tips for Saving Money on Life Insurance Premiums as a New Accounts Clerk in Banking

Saving Money on Life Insurance Premiums: As a new accounts clerk in banking, it’s important to choose life insurance coverage that aligns with your needs and budget. Here are some tips for lowering your premium costs:

- Shop around for quotes from different insurers to find the most affordable rates.

- Consider term life insurance, which typically has lower premiums than whole or universal life insurance.

- Maintain good health habits, such as exercising regularly and avoiding tobacco use, to secure lower premiums.

- Choose an appropriate coverage amount: purchasing more coverage than you need will increase your monthly cost. Consider what expenses you’d like covered if something were to happen, but don’t go overboard.

By following these strategies, you can save money while still getting reliable coverage that offers financial protection for yourself and your loved ones.

Common Mistakes to Avoid When Purchasing Life Insurance as a New Accounts Clerk in Banking

Overlooking the Importance of Life Insurance Coverage as a New Accounts Clerk in Banking

Many new accounts clerks in banking make the mistake of overlooking the importance of life insurance coverage. It’s easy to assume that because you’re young and healthy, you don’t need it. However, accidents can happen at any time, and unexpected illnesses can quickly accumulate medical bills. Additionally, if anyone depends on your income, such as a spouse or children, not having life insurance puts them at risk if something were to happen to you. Don’t wait until it’s too late – ensure that you have adequate life insurance coverage to secure your loved ones’ future financial stability.

Failing to Assess Your Life Insurance Needs Before Making a Purchase

One of the biggest mistakes that new accounts clerks in banking make when purchasing life insurance is failing to assess their needs before making a purchase. It’s important to evaluate your financial situation, outstanding debts, and future expenses to determine the appropriate amount of coverage you need. Underestimating your life insurance needs can result in inadequate coverage for your loved ones if something were to happen to you. On the other hand, overestimating can lead to unnecessarily high premiums that strain your budget. Take the time to calculate your coverage requirements carefully before choosing a plan so that you have peace of mind knowing you’ve made an informed decision.

Choosing the Cheapest Option Without Considering the Coverage

Choosing the cheapest life insurance option without considering the coverage is a common mistake that new accounts clerks in banking make. While it may seem like a good idea to save money on premiums, it can end up costing you more in the long run if the coverage is inadequate. It’s important to remember that the cheapest option may not provide enough coverage for your needs, leaving your loved ones financially vulnerable in case of an unexpected event. Instead, focus on finding a policy that offers adequate coverage at a reasonable price. Don’t compromise on coverage just to save a few dollars on premiums.

Not Reviewing and Updating Your Life Insurance Policy Regularly

It’s important to remember that your life insurance needs may change over time, especially as you progress in your career as a new accounts clerk in banking. Failing to review and update your policy regularly can lead to inadequate coverage or paying for coverage you no longer need. Make sure to review your policy at least once a year and after any major life events such as marriage, having children, or buying a home. Additionally, be sure to notify your insurance provider of any changes in your health or lifestyle that may affect your coverage. Keeping your policy up-to-date ensures that you have the right amount of coverage for your current needs.

Making an Informed Decision: Choosing the Best Life Insurance Coverage for Your Needs as a New Accounts Clerk in Banking

Choosing the best life insurance coverage for your needs as a new accounts clerk in banking requires careful consideration of several important factors. First, assess your financial situation and determine how much coverage you need to adequately protect yourself and your loved ones. Next, consider the type of coverage that best suits your needs – term or permanent. Term policies provide affordable coverage for a specific period, while permanent policies offer lifelong protection with added benefits such as cash value accumulation.

When comparing quotes and rates from different insurers, be sure to weigh the cost against the level of coverage provided. Look for insurers with strong financial ratings and customer satisfaction reviews.

Remember to avoid common mistakes such as underestimating your insurance needs or purchasing unnecessary riders that drive up premiums.

By taking these steps and making an informed decision about your life insurance options, you can achieve peace of mind knowing that you have adequate protection in place for unexpected events.

In conclusion, as a new accounts clerk in banking, life insurance coverage is an essential aspect of your financial planning. By understanding the basics of life insurance, the types of coverage available, and the factors to consider when choosing coverage, you can make an informed decision that meets your needs and budget. Remember to determine the right amount of coverage, compare quotes and rates, and take advantage of tips for saving money on premiums. By avoiding common mistakes and following this step-by-step guide, you can master life insurance options and secure the best coverage for your future.